Introduction

Navigating the financial landscape of caregiving can feel overwhelming for families. The many factors that influence caregiver prices can add to the stress. From personalized care plans tailored to specific needs to the significant regional differences in costs, every choice can have a big impact on overall expenses. Families often find themselves asking: how can they make informed decisions while managing their budgets?

This article explores ten key factors that shape caregiver prices. We aim to provide insights and strategies that help families optimize their caregiving experience while keeping costs manageable. Remember, you’re not alone in this journey. Together, we can find the best solutions for your loved ones.

Happy to Help Caregiving: Personalized Care Plans Impacting Pricing

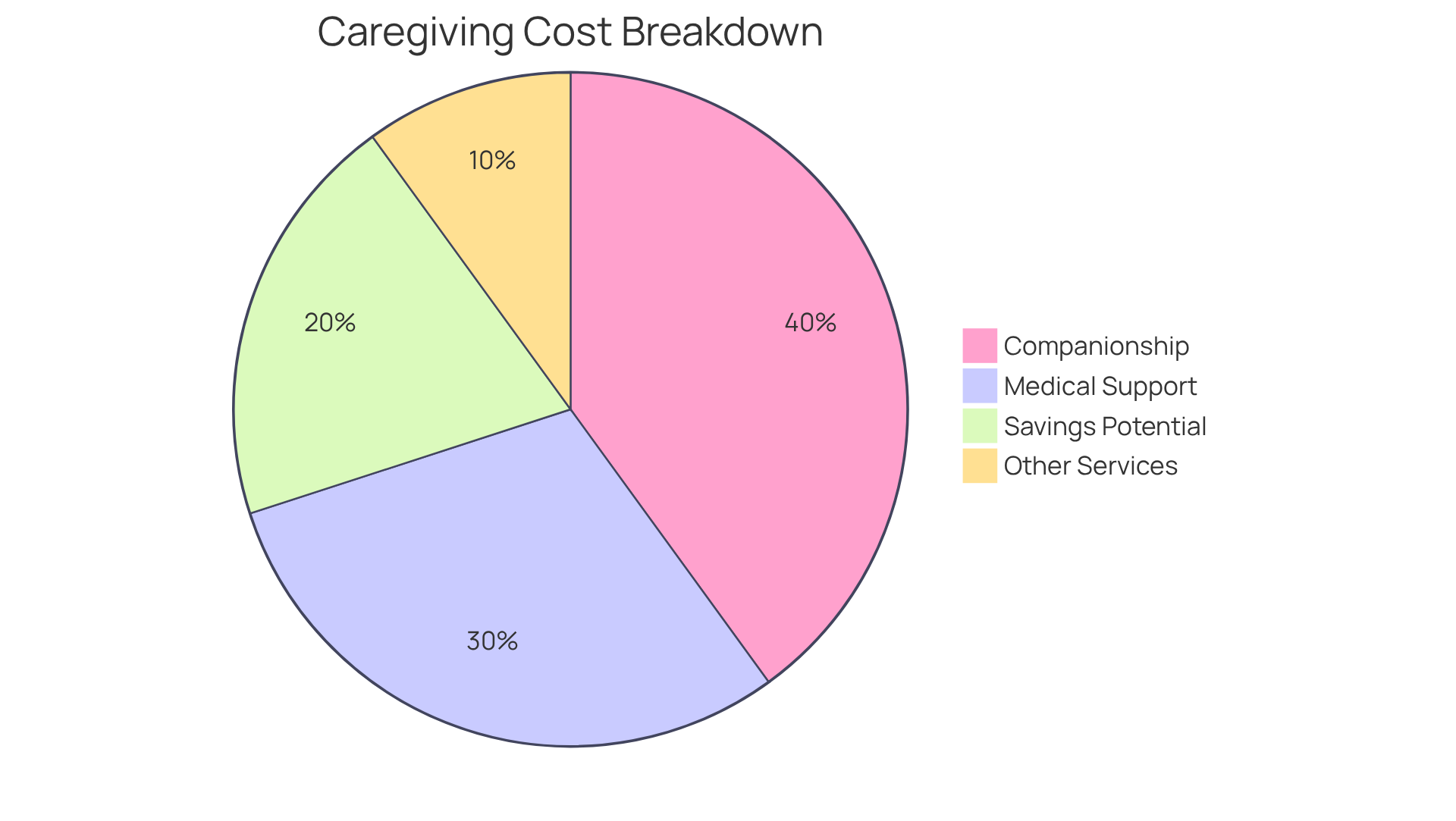

Personalized support plans are vital for effective assistance, and at Happy to Help Assistance, we truly understand that each client has unique needs. By customizing our services, we not only enhance the quality of care but also help families save significantly on caregiver prices over time. For example, a client who simply needs companionship may find their expenses much lower than someone requiring extensive medical support.

Did you know that households can cut costs by as much as 20% by choosing services with caregiver prices tailored to their specific needs? By carefully evaluating what’s truly necessary, families can avoid unnecessary expenses and ensure that caregiver prices reflect only the essential services they require. This thoughtful approach to caregiving not only improves how resources are allocated but also helps manage caregiver prices, supporting a more sustainable financial strategy for families navigating the complexities of in-home care.

Understanding the essentials of in-home caregiving is crucial. It empowers families to make informed decisions that can significantly affect their overall expenses. We’re here to help you every step of the way, ensuring that you feel supported and confident in your choices.

State Variability: How Location Affects Caregiver Prices

Navigating caregiver prices across the United States can feel overwhelming, especially when you consider how much they vary based on where you live. In states like California and New York, where the cost of living is higher, caregiver prices might range from $30 to $50 per hour. On the other hand, states with lower living expenses, such as Texas and Mississippi, offer more affordable caregiver prices, which typically range between $18 and $31 per hour.

In Massachusetts, caregiver prices fluctuate from $29 to $37 per hour, while in Florida, you can expect to pay between $25 and $33. It’s also important to keep in mind that hiring a caregiver for weekends or holidays may come with additional charges of $5 to $10 per hour. As of 2025, the national median caregiver prices for in-home assistance are $33 per hour, which can serve as a helpful benchmark for families assessing local rates.

This variation underscores the importance of doing thorough research on caregiver prices in the local area. Understanding how geographic factors influence caregiver prices can significantly impact your caregiving budget. By understanding the nuances of state-specific caregiver prices, families can make informed decisions that align with their financial situation and the needs of their loved ones. Remember, you’re not alone in this journey; seeking the right support can make all the difference.

Type of Care: The Role of Service Specificity in Pricing

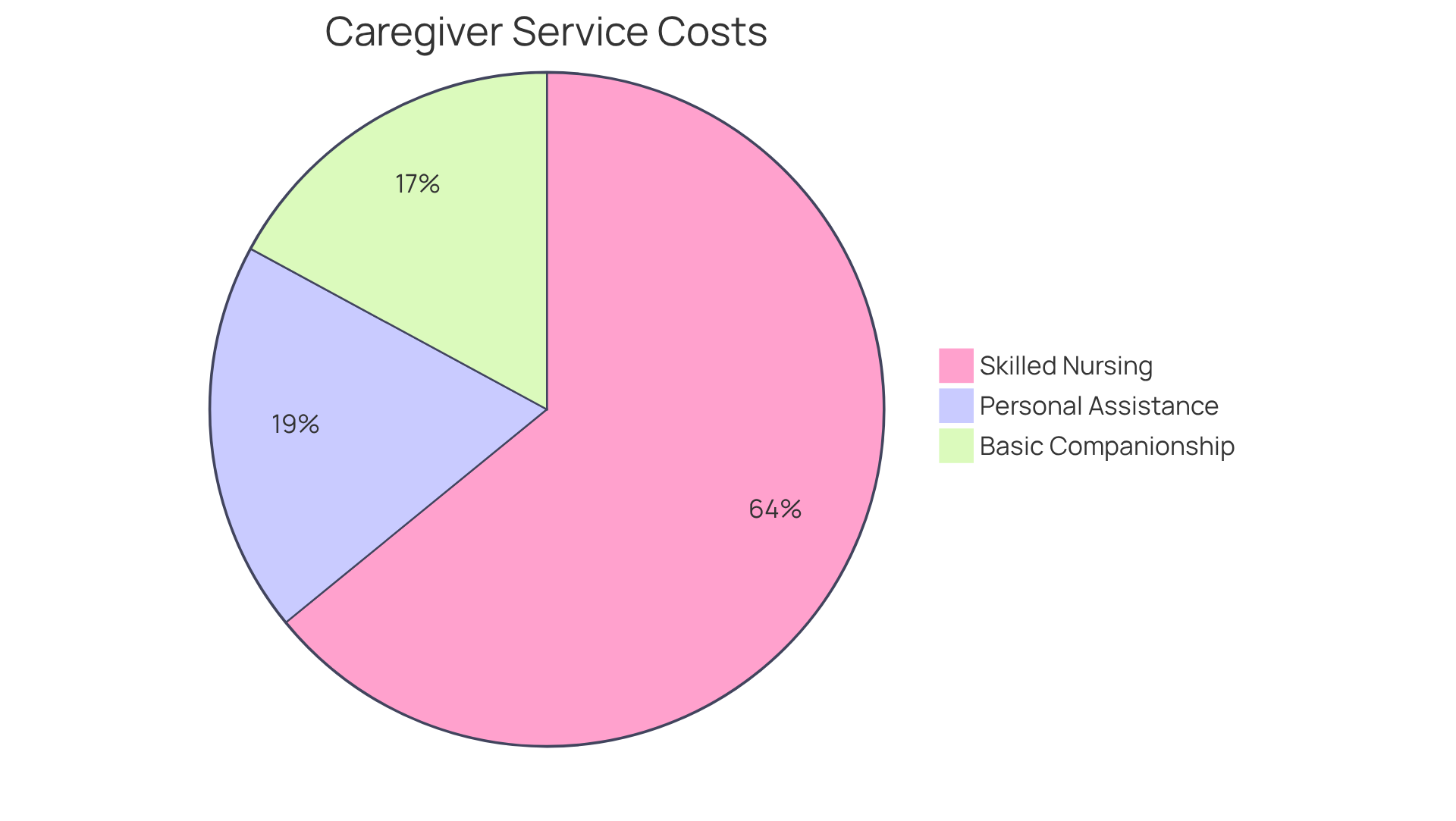

Understanding the kind of assistance you need is crucial, especially when it comes to managing expenses. For many families, the journey can feel overwhelming. Basic companionship services, which offer emotional support and help with light household tasks, usually have caregiver prices that range from $15 to $25 per hour in places like New York. This can provide a comforting presence for loved ones, easing some of the emotional burden.

On the other hand, specialized medical services require trained professionals and can have caregiver prices that are significantly more costly, often exceeding $50 per hour. For example, caregiver prices for personal assistance average around $22 per hour, while those for skilled nursing services can vary from $50 to $100 per hour. This variation often depends on the complexity of medical needs and where you live.

It’s essential for families to clearly define the type of assistance they require. This clarity not only helps in preparing for the associated expenses but also ensures that they choose the right level of support for their loved ones. Remember, you’re not alone in this journey. Understanding the available financial support options can further help families manage these costs, providing peace of mind as they navigate this challenging time.

Agency vs. Direct Hiring: Cost Implications for Families

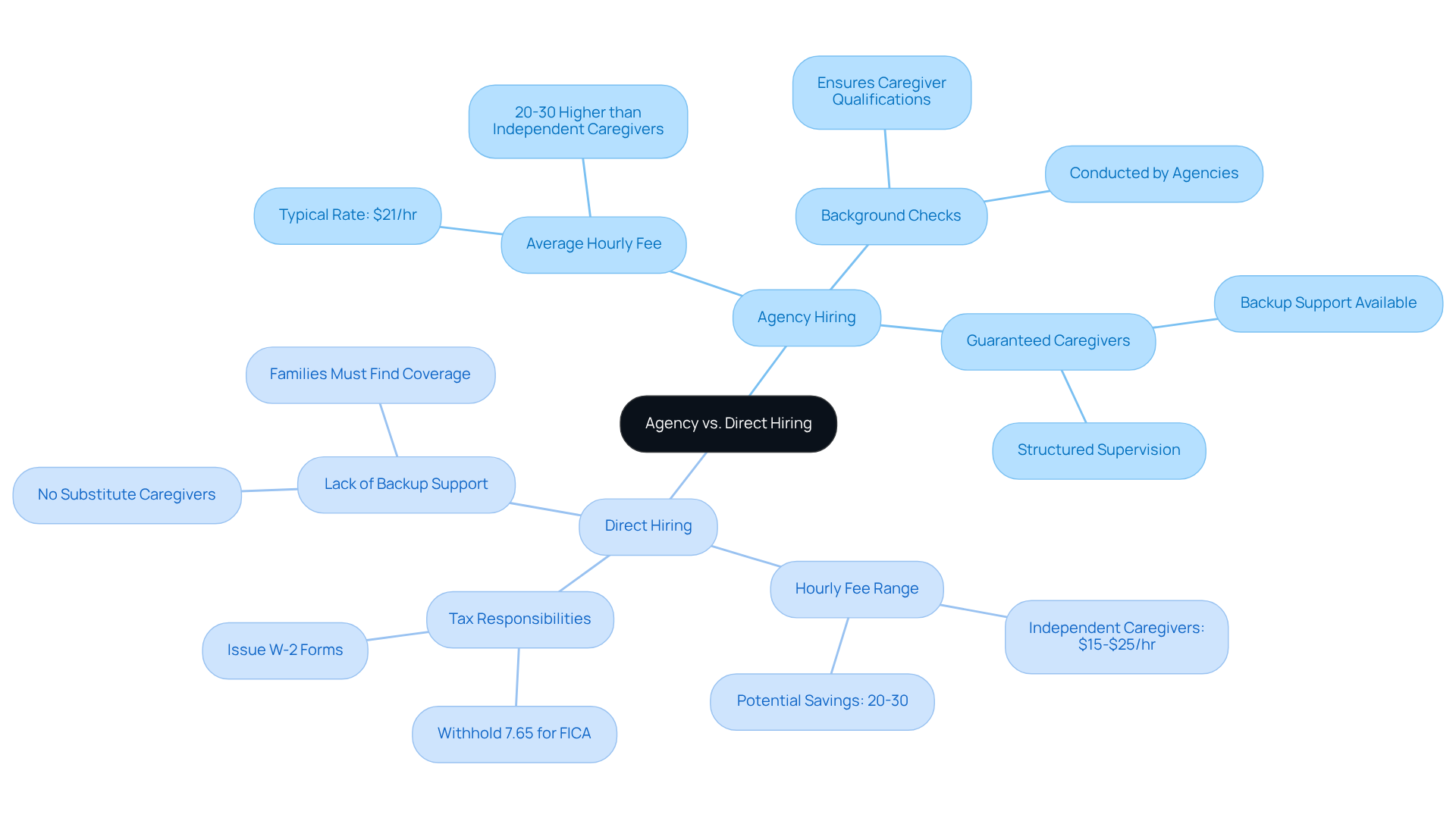

When families think about hiring a caregiver, it’s important to consider the caregiver prices of choosing between an agency and direct hiring. Home support agencies often charge higher caregiver prices, with the average hourly fee hovering around $21. This reflects the costs associated with background checks, training, and liability insurance. In fact, caregiver prices for agency services can be 20-30% higher than the rates charged by independent caregivers, who typically charge between $15 and $25 per hour.

However, it’s crucial for families to weigh the responsibilities that come with direct hiring. This includes managing payroll, withholding taxes, and ensuring compliance with labor laws. For instance, families must withhold 7.65% for FICA taxes and issue W-2 forms, which can complicate the process and might offset any potential savings. Additionally, when hiring independently, families miss out on the safety net of agency-provided backup support workers. This can lead to disruptions in care if the primary caregiver is unavailable.

Agencies, on the other hand, offer organized supervision and guaranteed caregiver substitutes, ensuring reliable assistance. By understanding these financial factors, including the significance of caregiver prices and thorough background checks when hiring independently, families can make informed decisions that align with their budget and support needs. Remember, it’s about finding the right balance between cost and the peace of mind that comes from knowing your loved ones are in good hands.

Care Frequency and Duration: Key Pricing Influencers

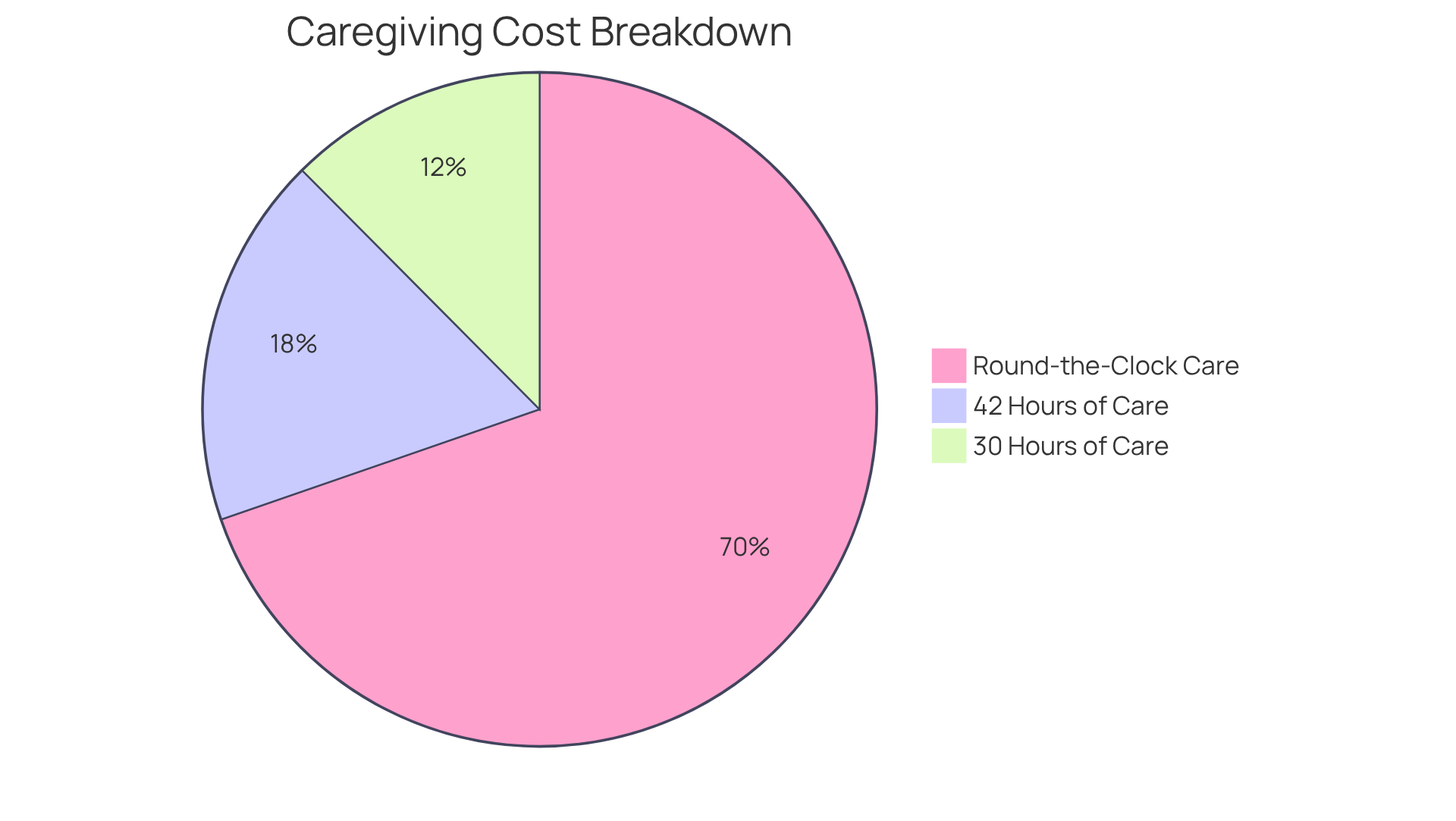

Navigating the world of caregiving can be overwhelming, particularly regarding caregiver prices. Families often find themselves facing significant monthly costs, particularly when they have to account for caregiver prices for daily support. For example, round-the-clock home assistance can reach nearly $17,472 each month. In contrast, those needing just a few hours of help each week might see expenses averaging between $4,368 and $4,583 for 42 hours of care.

To provide further clarity, consider that 30 hours of in-home assistance typically costs around $3,120. This information is vital for families as they consider their options regarding caregiver prices. It’s important to note that longer shifts often come with lower hourly rates, making them a more economical choice. On the other hand, short, frequent visits can add up quickly, leading to unexpected financial strain.

Families should take the time to evaluate their specific needs and budget carefully. Striking a balance between adequate support and caregiver prices is essential. For instance, the Martinez household has found success with a hybrid strategy, spending $3,200 monthly by combining in-home and community services. This approach illustrates how families can effectively meet their support needs while keeping caregiver prices in check.

Understanding these dynamics empowers families to make informed decisions regarding caregiver prices that align with their financial capabilities and caregiving requirements. As Ryan Sanderson wisely notes, live-in support often proves to be a more economical option compared to traditional residential facilities. This highlights the importance of considering all financial factors when arranging for assistance. Remember, you’re not alone in this journey; there are options available that can help ease the burden.

Specialized Care Needs: Understanding Additional Costs

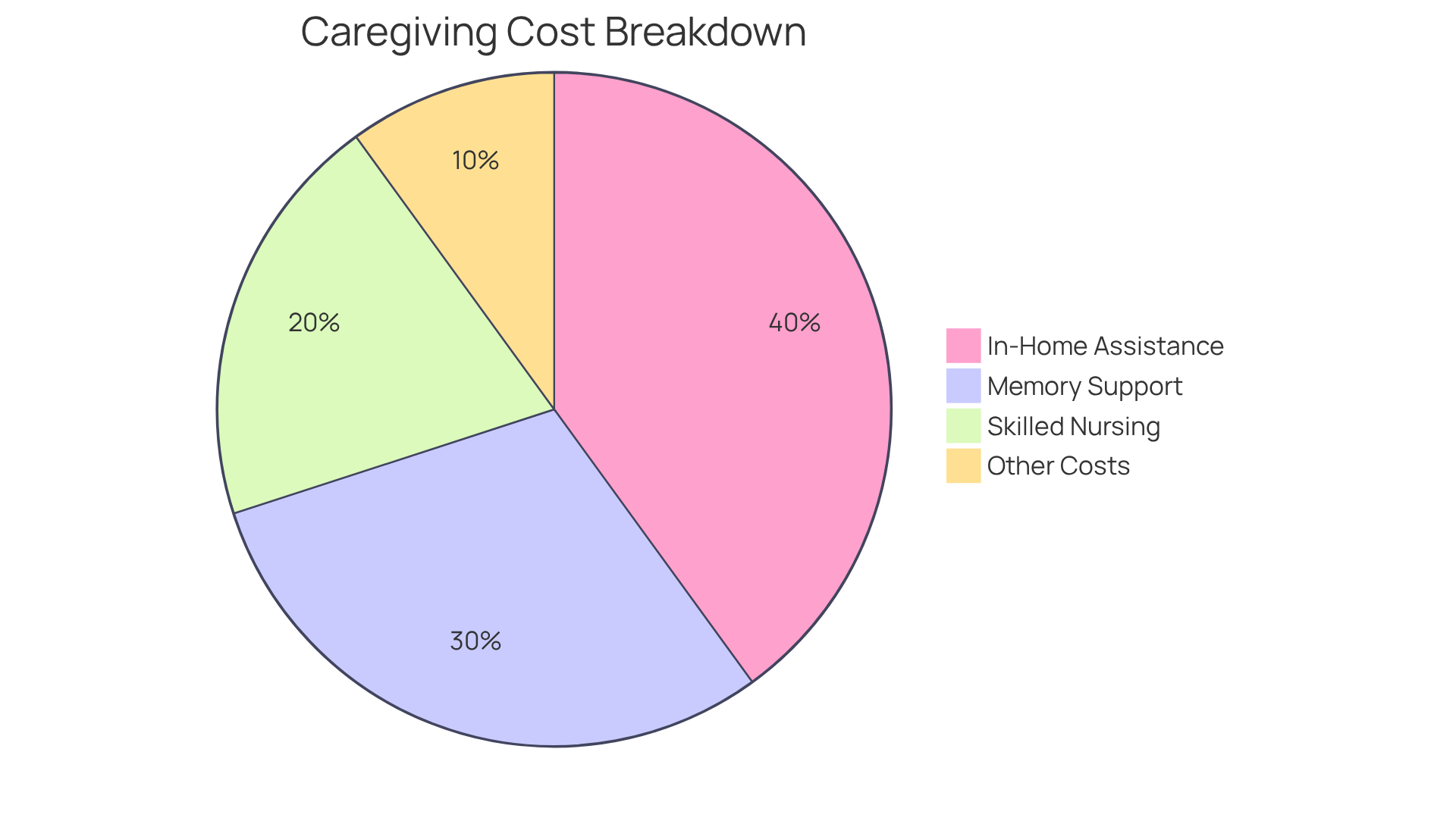

Caring for a loved one with specific needs, like dementia or recovering from surgery, can be a heavy burden. Families often face increased expenses related to caregiver prices for these essential services, which can add to the emotional strain. Caregiver prices typically reflect the complexity of the assistance required, with those having specialized training and expertise charging higher rates. For example, skilled nursing services can range from $50 to $130 per hour.

Additionally, memory support can increase monthly assisted living fees by $1,000 to $4,000, leading to yearly expenses that can approach $100,000 when considering all costs. It’s crucial for families to thoughtfully evaluate these potential expenses when preparing their caregiving budget. Without sufficient insurance coverage or financial aid options, the financial strain can feel overwhelming.

Connecting with home assistance organizations can provide valuable insights into caregiver prices and the available services. This way, families can make informed decisions that best suit their loved ones’ needs. On average, the monthly cost for medical-type in-home assistance services is around $5,462 for 44 hours each week, which may be partially covered by Medicare if the provider is Medicare-certified.

Moreover, families are encouraged to explore financial support options for home assistance, including health insurance and community services. Remember, you’re not alone in this journey. There are resources and support systems available to help lighten the load.

Combining Services: Strategies for Cost Savings

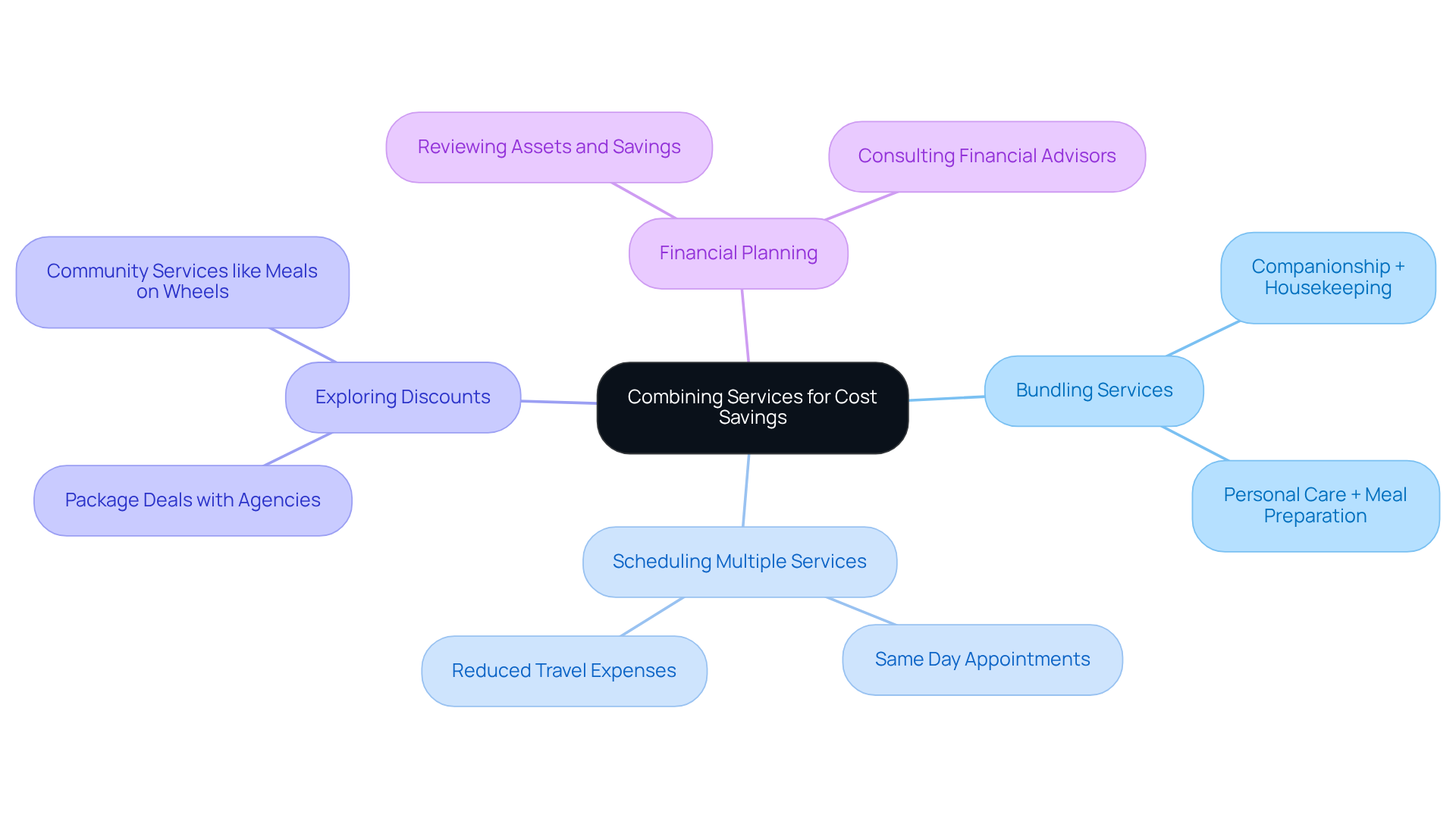

Merging caregiving services presents a heartfelt opportunity for families to reduce caregiver prices while ensuring comprehensive support for their loved ones. Imagine combining companionship assistance with light housekeeping; often, these services can be bundled at a lower price, making it a more affordable choice. With the national median caregiver prices for nonmedical in-home assistance projected to be $33 per hour in 2025, it’s crucial to explore savings options that can ease the financial burden.

Scheduling multiple services on the same day not only adds convenience but also cuts down on travel expenses for caregivers, further lowering overall costs. Families are encouraged to have open conversations with their caregiving agency to discover caregiver prices, including package deals or discounts tailored to their unique needs. As personal finance expert Laura Adams wisely points out, “Few people are really prepared for their own financial emergencies, much less for that of a relative or aging parent.”

By taking advantage of these combined service options, families can achieve significant savings on caregiver prices while ensuring their loved ones receive high-quality support. Additionally, considering community services like Meals on Wheels can provide extra low-cost or even free assistance for seniors, enhancing the overall support strategy. Together, these resources can create a nurturing environment that addresses both emotional and practical needs.

Tax Deductions: Financial Relief for In-Home Care Expenses

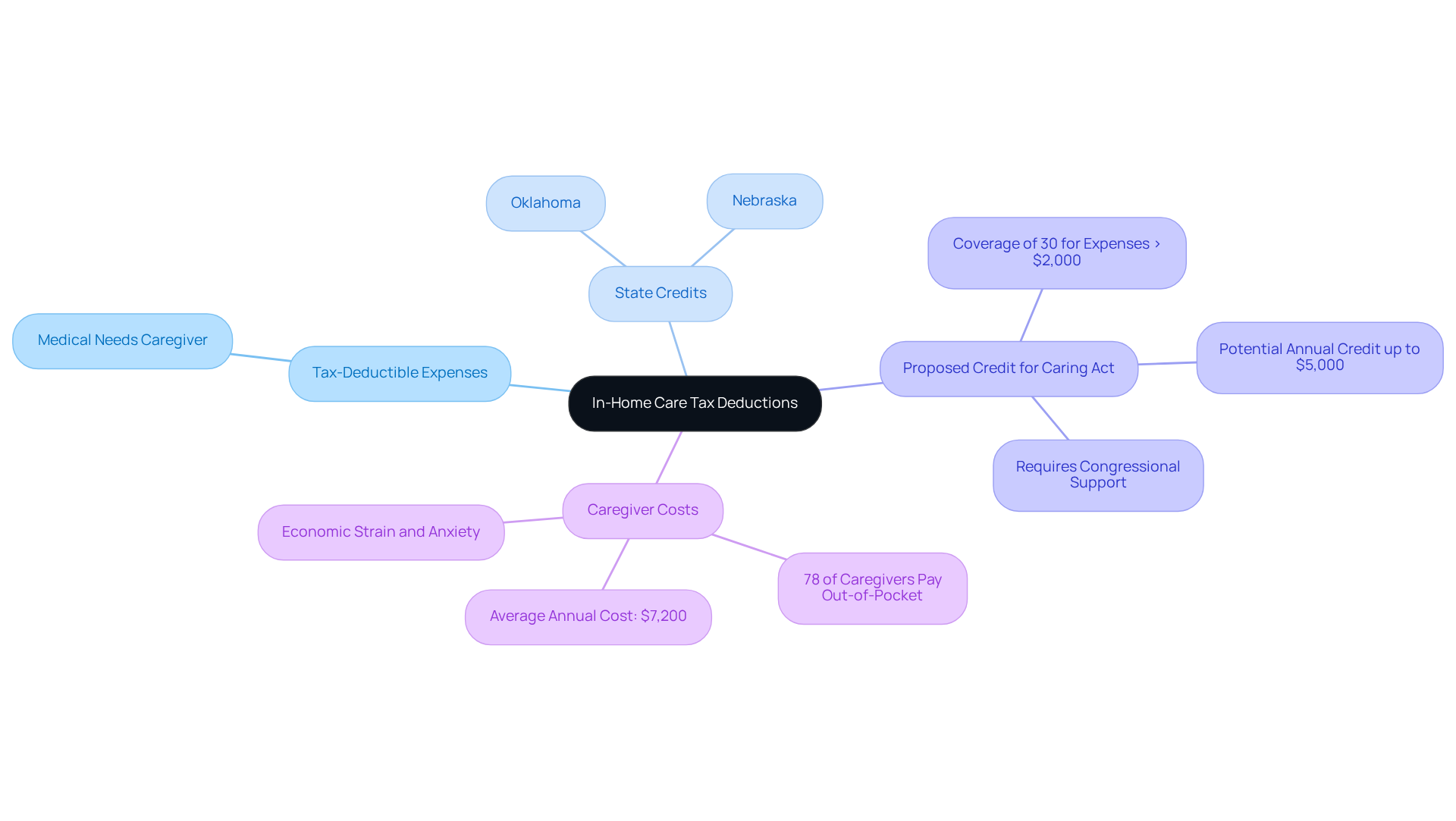

Families often find themselves navigating the emotional and financial challenges related to caregiver prices. It’s important to recognize that certain in-home care expenses can be tax-deductible, which may offer some much-needed financial relief. For instance, hiring a caregiver to assist with medical needs might allow families to categorize these expenses as medical deductions on their tax returns.

Additionally, several states, like Oklahoma and Nebraska, have introduced caregiver tax credits that can provide further support. The proposed Credit for Caring Act aims to cover 30% of expenses exceeding $2,000 for eligible caregivers, potentially offering up to $5,000 each year. However, it’s essential to note that this act requires Congressional support for implementation, which brings a bit of uncertainty about its availability.

Given that around 78% of caregivers face significant out-of-pocket costs—averaging about $7,200 annually—understanding caregiver prices and financial relief options is crucial. As Nancy LeaMond from AARP poignantly states, “This adds to the economic strain they feel and anxiety about their long-term financial security.”

Consulting with a tax professional can be a valuable step for families, helping them navigate these options effectively. By maximizing deductions, families can alleviate some of the financial burdens associated with caregiving, allowing them to focus more on what truly matters—the care and well-being of their loved ones.

Common Monthly Cost Plans: What Families Can Expect

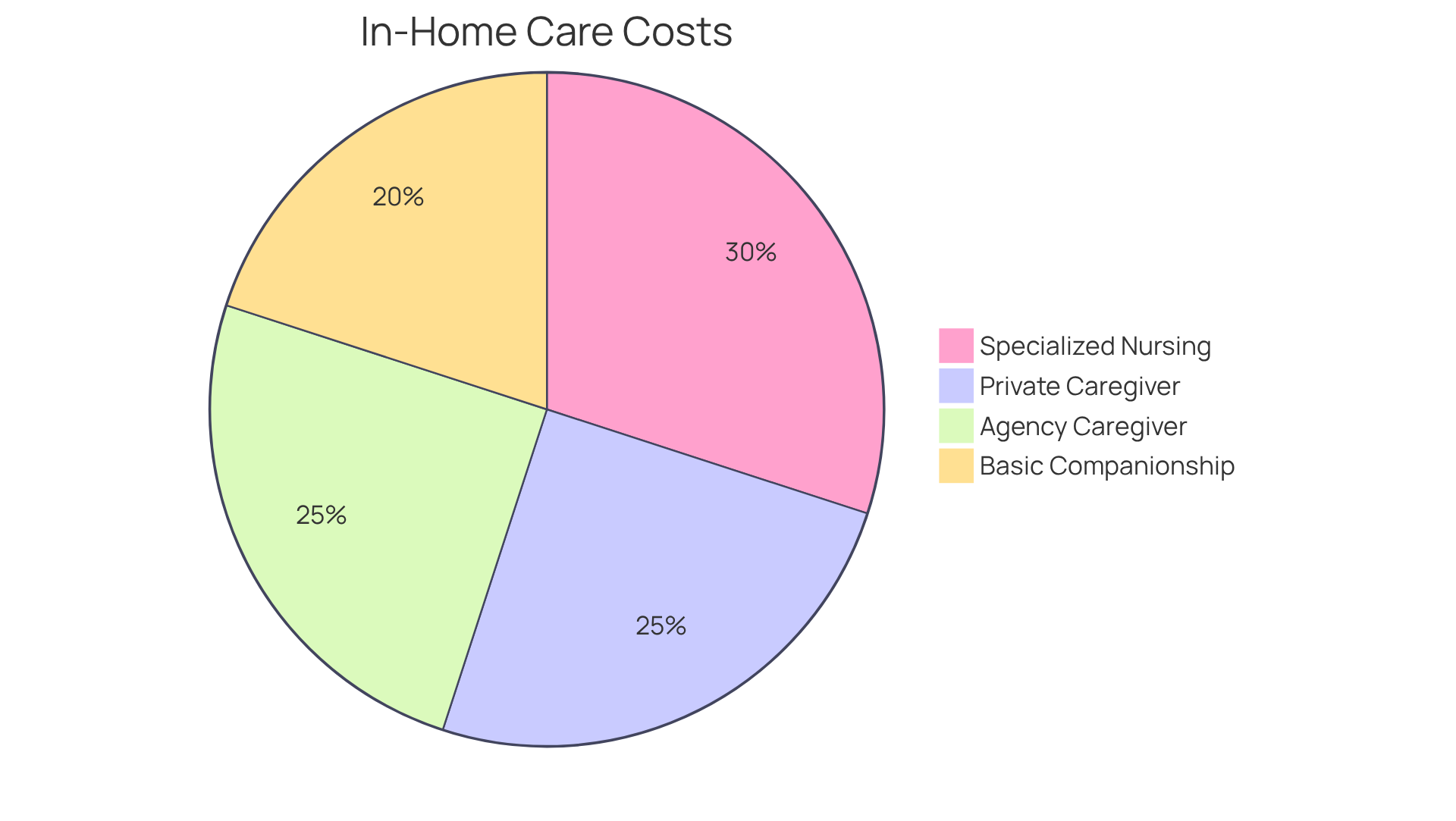

Families often find themselves navigating the emotional landscape of in-home assistance, with monthly costs typically ranging from $4,000 to $6,000. This variation largely depends on the level of service required. For instance, fundamental companionship assistance usually falls at the lower end of this spectrum, while specialized nursing services can lead to significantly higher expenses.

On a national scale, the median expense for in-home assistance hovers around $33 per hour. This can accumulate quickly, depending on how often and what type of services are needed. It’s important for families to consider that caregiver prices for hiring a private caregiver may cost between $20 to $30 per hour, while agency caregiver prices generally range from $30 to $40 per hour.

As you explore these options, take a moment to reflect on your specific needs. Seeking guidance from caregiving organizations can provide tailored estimates of caregiver prices, helping you understand the monetary implications of your choices. Many families discover that Medicare, Medicaid, and private health insurance plans can cover some of the costs associated with home assistance, which can significantly impact overall expenses.

Understanding the different types of services—like assistance with activities of daily living (ADLs) versus more intensive medical care—can empower families to make informed decisions that align with both their budget and care requirements. Remember, you’re not alone in this journey; there are resources and support systems available to help you every step of the way.

Conclusion

Understanding the factors that influence caregiver prices is crucial for families looking for in-home support. It’s important to recognize how personalized care plans, location, service type, and frequency of care can impact costs. This awareness helps families make informed decisions that align with their financial capabilities and caregiving needs. Tailoring services to specific requirements not only enhances the quality of care but can also lead to significant savings over time.

Throughout this discussion, we see that caregiver prices can vary dramatically based on:

- Geographic location

- The complexity of care required

- Whether services are obtained through an agency or directly hired

Families can save as much as 20% by opting for customized care plans and exploring options like combining services or seeking tax deductions. The financial implications of specialized care needs and the potential for substantial monthly expenses highlight the importance of careful budgeting and planning.

Navigating the complexities of caregiver pricing can feel overwhelming, but proactive engagement and a thorough understanding of available resources can make a difference. By leveraging community support, exploring financial relief options, and prioritizing the specific needs of loved ones, families can create a sustainable caregiving strategy. This approach not only provides necessary assistance but also alleviates financial burdens. The journey may be challenging, but with the right information and support, it’s possible to find a balance that ensures both quality care and financial peace of mind.

Frequently Asked Questions

Why are personalized support plans important for caregiving?

Personalized support plans are vital because they cater to each client’s unique needs, enhancing the quality of care and helping families save significantly on caregiver prices over time.

How much can families save by choosing tailored caregiver services?

Families can cut costs by as much as 20% by selecting services with caregiver prices that are tailored to their specific needs.

What factors affect caregiver prices in different states?

Caregiver prices vary significantly based on location, with higher costs in states like California and New York (ranging from $30 to $50 per hour) and lower prices in states like Texas and Mississippi (ranging from $18 to $31 per hour).

What are the typical hourly rates for caregiver services in Massachusetts and Florida?

In Massachusetts, caregiver prices fluctuate from $29 to $37 per hour, while in Florida, they typically range from $25 to $33 per hour.

Are there additional charges for caregivers during weekends or holidays?

Yes, hiring a caregiver for weekends or holidays may incur additional charges of $5 to $10 per hour.

What is the national median price for caregiver services as of 2025?

The national median caregiver prices for in-home assistance are $33 per hour.

How does the type of care required influence caregiver pricing?

Basic companionship services typically range from $15 to $25 per hour, while specialized medical services can exceed $50 per hour, depending on the complexity of medical needs and location.

What should families consider when defining the type of assistance they need?

Families should clearly define the type of assistance required to prepare for associated expenses and ensure they choose the right level of support for their loved ones.